Taking advantage of homebuying affordability

With a worldwide health crisis that drove a pause in the economy this year, the housing market has been impacted. Many have been eagerly awaiting some bright signs of a recovery. Based on the latest existing home sales report from the National Association of Realtors (NAR), June hit a much-anticipated record-setting rebound to ignite that spark.

According to NAR, home sales jumped 20.7% from May to a seasonally-adjusted annual rate of 4.72 million in June. “Existing-home sales rebounded at a record pace in June, showing strong signs of a market turnaround after three straight months of sales declines caused by the ongoing pandemic – Each of the four major regions achieved month-over-month growth.”

This significant rebound is a major boost for the housing market and the U.S. economy. According to Lawrence Yun, Chief Economist for NAR, the momentum has the potential to continue on, too: The sales recovery is strong, as buyers were eager to purchase homes and properties that they had been eyeing during the shutdown.

This revitalization looks to be sustainable for many months ahead as long as mortgage rates remain low and job gains continue.

With mortgage rates hitting an all-time low, dropping below 3% for the first time last week, potential homebuyers are poised to continue taking advantage of this historic opportunity to buy. This fierce competition among buyers is contributing to home price increases as well, as more buyers are finding themselves in bidding wars in this environment.

The report also notes: “The median existing-home price for all housing types in June was $295,300, up 3.5% from June 2019 ($285,400), as prices rose in every region. June’s national price increase marks 100 straight months of year-over-year gains.”

Yun also indicates: “Home prices rose during the lockdown and could rise even further due to heavy buyer competition and a significant shortage of supply.”

Mortgage Rates Hit Record Lows for Three Consecutive Weeks

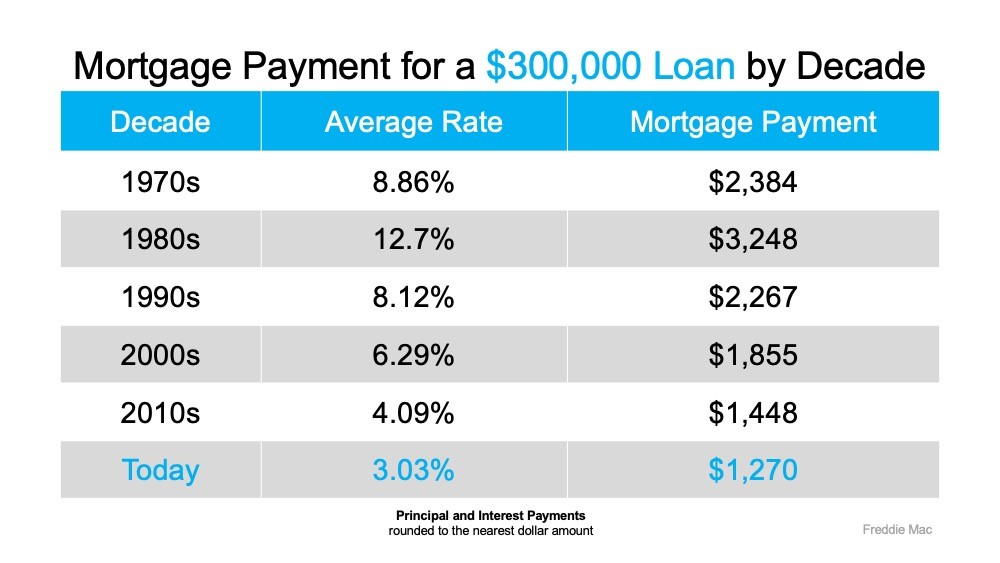

Over the past several weeks, Freddie Mac has reported the average 30-year fixed mortgage rate dropping to record lows, all the way down to 3.03%. Last week’s reported rate reached the lowest point in the history of the survey, which dates back to 1971 (See graph below):

What does this mean for buyers?

This is huge for homebuyers. Those currently taking advantage of the increasing affordability that comes with historically low interest rates are winning big. According to Sam Khater, Chief Economist at Freddie Mac:“The summer is heating up as record low mortgage rates continue to spur home buyer demand.”

In addition, move.com notes:“Summer home buying season” is off to a roaring start. As buyers flooded into the market, realtor.com® monthly traffic hit an all-time high of 86 million unique users in June 2020, breaking May’s record of 85 million unique users. Realtor.com® daily traffic also hit its highest level ever of 7 million unique users on June 25, signaling that despite the global pandemic buyers are ready to make a purchase.”

The local real estate market in Sarasota is currently sizzling. A wave of buyers typically seen during the spring season has been delayed due to the pandemic, but we are now seeing these buyers flooding our market. Homes that are on the market are finding buyers quickly. Low mortgage rates, rising home values, and steep competition are defining this summer from a real estate perspective.

Clearly, buyers are capitalizing on today’s low rates. As shown in the chart below, the average monthly mortgage payment decreases significantly when rates are as low as they are today.

A lower monthly payment means savings that can add up significantly over the life of a home loan. It also means that qualified buyers may be able to purchase more home for their money. Maybe that’s a bigger home than what they’d be able to afford at a higher rate, an increasingly desirable option considering the amount of time families are now spending at home given today’s health concern.

Buyers returning to the market is a great sign for the economy, as housing is leading the way toward a recovery.

If you’re in a position to buy a home this year, let’s connect to determine your best next steps toward homeownership and to initiate the process while mortgage rates are historically low. You can contact me today at 941.266.0529 or send an email to stacyhanan@michaelsaunders.com, if you have any questions about the homes for sale in Sarasota or the local real estate market!