Does a Recession Equal a Housing Crisis?

One of the topics of conversation right now is, “does a recession mean that we are heading toward a housing crisis”. The short answer is no, a recession is not synonymous to a housing crisis. That’s the one thing that every buyer and seller today needs to know. And an economic slowdown does not mean that your home will lose value. Many buyers are noticing price reductions and wondering if this is the beginning of a decline. So far, most price corrections have been against recently inflated asking prices, not against the underlying actual home value. While history doesn’t always repeat itself, we can learn from it and find comfort in the historical data.

According to the National Bureau of Economic Research, a recession is defined as “a significant decline in economic activity spread across the economy, normally visible in production, employment, and other indicators. A recession begins when the economy reaches a peak of economic activity and ends when the economy reaches its trough.” Or, a quickie definition is simply two consecutive quarters of falling gross domestic product, which we saw happen in the first half of 2022.

History – The Bigger Picture

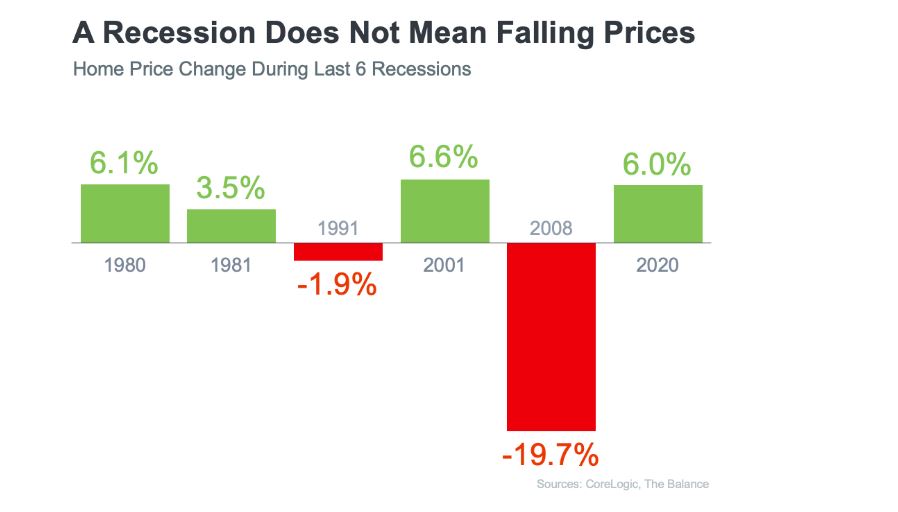

History shows us that home prices don’t always fall during a recession. Looking at the recessions dated back to 1980, home prices appreciated in four of the last six recessions. And mortgage rates declined during each of the previous recessions. What this shows is that during a recession, real estate is an asset class that is sounder than other options.

In fact, only during two such periods have home values actually depreciated. One being in the early 1990s and the other again during the housing crisis of 2008. Most of us vividly remember the housing crisis in 2008, and most people think we might see a repeat of this. The difference is that we are not going through a bubble as we did from 2005-2008.

Looking back on mortgage rates, we can see that, since the 1980’s, the 30 year fixed has typically fallen during recessions. Since recessions come with reduced economic activity and higher unemployment rates, it makes sense that there is less demand for mortgage financing. With less demand, interest rates fall.

What this shows us, is that even if we are starting to see the dreaded “R” word, it doesn’t mean that homes will lose value, or that we are headed for a housing crisis. Borrowing may cost a little more than it did a few months ago, but real estate has proven that it has historically been and continues to be a strong investment choice.

Returning to a “Normal” Market

After two years of unprecedented growth in home sales, the market began to shift in mid-April 2022. We are no longer in a frenzied boom market nationally or locally. Nobody can predict the future; but we can make an educated prediction based on our knowledge of the historic data and immediate past. The market in the Sarasota area today reflects the pattern in 2019 – which was a great year with a solid yet “normal” real estate market. Demand remains very high for reasons including low taxes, beautiful weather, the arts and culture scene, and changing feeder markets. Because of this, Florida and more specifically Sarasota and Manatee County, are uniquely positioned to ride out this recent transitory period far better than most of the country.

If you are thinking to buy or sell let’s connect to discuss why the housing market is nothing like 2008 and how you can be better prepared for your next real estate transaction. You can contact me today at 941.266.0529 or send me an email to stacyhanan@michaelsaunders.com